Dividend-Paying Stocks of Nancy Pelosi and Her Husband to Purchase

By: Paul Dykewicz,

Dividend-paying stocks of Nancy Pelosi and her husband for investors to purchase feature a New York financial firm and a world-famous technology company.

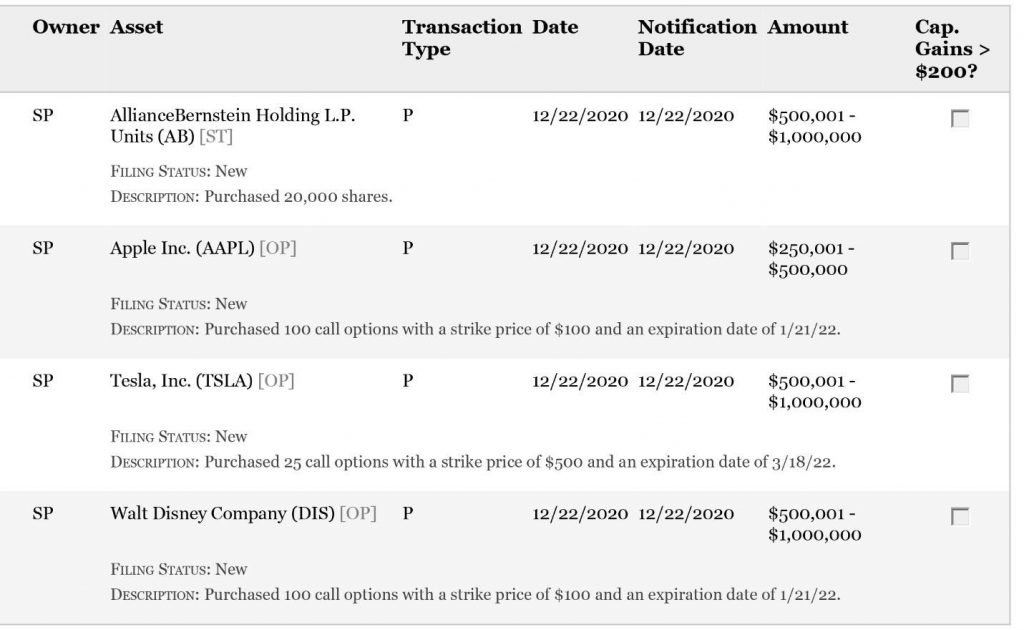

The dividend-paying stocks of Nancy Pelosi and her husband to purchase consist of investment management and research firm AllianceBernstein Holding L.P. (NYSE:AB) and giant Apple (NASDAQ:AAPL). The power couple further entered the spotlight when House Speaker Nancy Pelosi and her venture capitalist husband Paul made four big trades last Dec. 22 that included purchasing shares valued between $501,000 and $1 million in AllianceBernstein, along with call options in Apple and two other household-name companies for a combined $1,250,003 to $2,500,000, according to the House Speaker’s financial disclosure reports.

The dividend-paying stocks of Nancy Pelosi and her husband to purchase focused of investments that would appreciate if the companies thrived, and each also likely would be helped by passage of a federal stimulus package of $900 billion signed into law by former President Trump on Dec. 27 and a new $1.9 trillion funding bill that could be approved by Congress and signed by President Biden soon. Any decision about the merit of dividend-paying stocks of Nancy Pelosi and her husband to purchase should be based on an individual investor’s personal financial resources, risk tolerance and goals rather than political preferences.

The couple’s trades on Dec. 22 led to the purchase of 20,000 shares of AllianceBernstein Holding L.P., as well as buying call options in Apple, electric vehicle manufacturer Tesla Inc. (NASDAQ:TSLA) and entertainment and leisure giant Walt Disney Co. (NYSE:DIS). The call options are bullish trades that provide the buyer the right to purchase shares in each stock for a specific share price, called the strike price, until the expiration date.

House Speaker Pelosi and her husband purchased 100 call options at a strike price of $100 in Apple that expire January 21, 2022, 25 call options with a strike price of $500 in Tesla that expire on March 18, 2022, and 100 call options priced at $100 in Disney that expire on January 21, 2022. The value of each trade ranged between $250,001 and $500,000 for the acquisition of Apple call options, and spanned $500,001 and $1,000,000 for the Tesla transaction and $500,001 and $1,000,000 for the Disney deal.

Source: Clerk of the U.S. House of Representatives

Political Dissenter Praises Non-Dividend and Dividend-Paying Stocks of Nancy Pelosi and Her Husband to Purchase

“Speaker Pelosi and I don’t see the world through the same political lens, but when it comes to where she puts her money, well, I can’t fault any of her vision,” said Jim Woods, editor of Successful Investing, Intelligence Report and Bullseye Stock Trader. “I am pleased to learn that Pelosi is a fan of Apple, Disney, AllianceBernstein and particularly Tesla. And while I might not like the politics the speaker pushes, her decision to push her own money into these stocks is one that I would be inclined to vote for.”

Columnist and author Paul Dykewicz meets with stock picker Jim Woods before COVID-19.

There are caveats to consider whenever someone weighs investing based on someone else’s required financial disclosure forms.

First, Speaker Pelosi and her husband are “very wealthy people,” said Bob Carlson, chairman of the Board of Trustees of Virginia’s Fairfax County Employees’ Retirement System with more than $4 billion in assets. Keep in mind the investments identified in the document are a “very small portion” of their net worth, he added.

Estimates of the net worth of Speaker Pelosi and her husband vary from tens of millions of dollars to upward of $100 million. The International Business Times reported in September 2020 that Speaker Pelosi is one of the wealthiest members of Congress, with a net worth of $114 million, but that is near the high end of public estimates.

Unique Factors May Affect Dividend-Paying Stocks of Nancy Pelosi and Her Husband to Purchase

Speaker Pelosi and her husband could have made the investments because of unique information, insights, or intuition, Carlson said. But the investments also could be “fun money,” or similar aggressive strategies often engaged in by the wealthy, he added.

“Second, we don’t know the time frame and price targets of the investments,” said Carlson, who also heads the Retirement Watch investment newsletter. “Options trades typically are made by people expecting to profit within a short time.”

As a result, Speaker Pelosi and her husband might have exited the trades before the investing public learned about them, Carlson continued.

“Third, we don’t know the rest of their portfolio,” Carlson counseled. “The options trades could be some kind of hedge, or a position used to balance or offset other positions. There also could be tax reasons for making trades. We can make assumptions, but we don’t really know.”

Pension fund and Retirement Watch leader Bob Carlson answers questions from Paul Dykewicz prior to COVID-19-related social distancing.

Dividend-Paying Stocks of Nancy Pelosi and Her Husband to Purchase May Be His Choices

A venture capitalist and owner of a San Francisco-based investment firm called Financial Leasing Services LLC, Paul Pelosi may be directing the trades for his politically powerful wife and him that she reports to the clerk of the U.S. House of Representatives.

“He’s been an active trader over the years with a taste for blue-chip stocks,” said Hilary Kramer, who hosts the nationally aired “Millionaire Maker” radio program and heads the GameChangers and Value Authority advisory services. “To his credit, he doesn’t seem to sell bad news or short companies that stand to suffer if his wife votes to raise taxes, tighten regulations or otherwise gets in their way. Betting against those companies is a very different story. We only buy short-term puts in my options services like High Octane Trader when we see that the stocks have gotten ahead of themselves. Long term, I’m a perma-bull and it looks like Paul Pelosi is, too.

“His timing is often more what I’d call opportunistic than calculated. What exactly happened on Dec. 22 that triggered these trades? A fresh round of stimulus finally passed, but it wasn’t exactly a consumer windfall. If anything, the COVID-19 narrative got worse for companies like Disney. He missed all of his quarterly dividend payments, which is a fairly big reason to buy a company like AllianceBernstein. And while the Tesla options have done well, he left a lot of money on the table for someone who theoretically had an inside track. That was a conservative bet on a powerhouse stock on the eve of its addition to the S&P 500. And yet he paid extra to buy an extra year for it to pay out.”

Paul Dykewicz conducts a pre-COVID-19 interview with Hilary Kramer, whose whose premium advisory services include IPO Edge, 2-Day Trader, Turbo Trader and Inner Circle.

Dividend-Paying Stocks of Nancy Pelosi and Her Husband to Purchase Raise Ethical Questions

The outlook of the non-dividend and dividend-paying stocks of Nancy Pelosi and her husband to purchase is a different question than whether congressional leaders or any lawmakers should be trading from their privileged perch that gives them access to information about potential laws and regulations that would not be known to the public. For example, as the top leader of the U.S. House of Representatives, Speaker Pelosi can help to direct if a federal stimulus package will be passed and when it may happen, since she and her fellow Democrats control the House, the Senate and the White House.

“As far as I’m concerned, everyone in the government should be bound to the same rules that prohibit corporate insiders from getting ahead of the general public,” Kramer said. “The simplest way to do this is for politicians, as well as their close relatives and confidants, to delegate supervision of their investment accounts to an outside advisor during the time of office.

“The alternative is for the politician to face suspicion of passing on tips, especially when the trades go well or benefit him or her directly in some way. A spousal account definitely qualifies for that, so unless Nancy Pelosi wants to recuse herself from every single briefing and vote that weighs on her husband’s positions, she would have saved herself a lot of headaches by asking him to stop trading their account years ago.”

Dividend-Paying Stocks of Nancy Pelosi and Her Husband to Purchase Include ‘Magical’ Entrant Disney

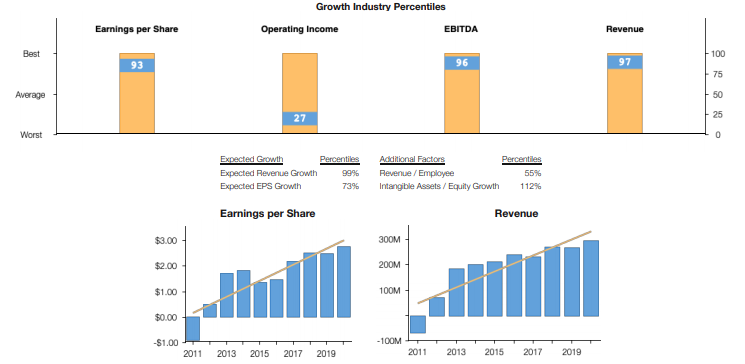

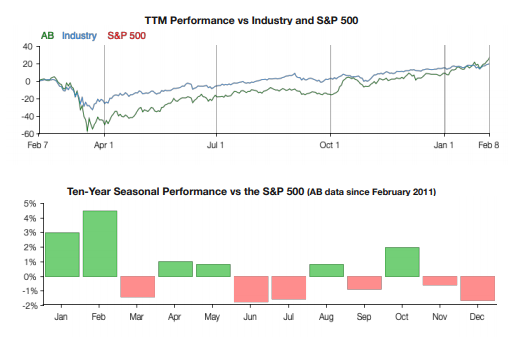

I like AllianceBernstein as a dividend stock for income-seeking investors, such as retirees or risk-averse people who are worried about another market crash similar to the one I prediced that occurred last year between Feb. 20 and April 7. The stock offers a dividend yield of 7.17% and trades at a modest price-to-earnings (P/E) ratio of 14.17, but also entails risks.

Source: Stock Rover

One seasoned Wall Street trader who has recommended investing in AllianceBernstein three times since 2013 is Bryan Perry, who writes a monthly newsletter called Cash Machine that features dividend-paying equities. On each occasion, he included the AllianceBernstein purchases in Cash Machine‘s Accelerated Income portfolio.

Paul Dykewicz interviews Bryan Perry at a MoneyShow event.

One trade took place on October 28, 2013, and Perry counseled to hold the position until July 15, 2015, when he recommended selling for a 29.32% gain. The second trade occurred on March 27, 2018, but he advised selling just five months later on August 28, 2018, for a profit of 20.84%. Perry’s third trade of AllianceBernstein began on January 7, 2020, before ending slightly more than 10 months later when he called for his subscribers to sell the stock for a 28.38% return.

With such a track record of double-digit-percentage returns in recent years from AllianceBernstein, I called Perry, who also leads the Premium Income, Quick Income Trader, Breakout Profits Alert and Hi-Tech Trader advisory services, to inquire why he currently is out of the position. He citied two key reasons: the stock’s now-elevated price and the annoyance that comes with the K-1 forms that master limited partnerships (MLPs) send their shareholders to review and report information when filing tax returns.

Chart courtesy of www.StockCharts.com

Dividend-Paying Stocks of Nancy Pelosi and Her Husband to Purchase Come With Convoluted K-1 Form

I once asked a tax accountant what he recommended for investors when they have a holding that sends a K-1 form. His response, “Sell it.”

The time needed to deal with the paperwork did not seem worth it to the tax accountant. If House Speaker Pelosi’s husband makes the buying and selling decisions in their investment portfolio, it also is likely he handles the K-1 reporting requirements, too. If the House Speaker herself took up the tedious task of tax preparation, she may have proposed or supported legislation to simplify the complicated K-1 forms while serving as a U.S. representative from California since 1987.

Stock Rover, a provider of investment research and analysis, ranked AllianceBernstein among its top choices for dividend investors. For a free two-week trial of the Stock Rover service, click here.

Source: Stock Rover

Dividend-Paying Stocks of Nancy Pelosi and Her Husband to Purchase Include Ascending Apple

Apple climbed and then retreated after Speaker Pelosi and her husband purchased call options aimed at profiting from the stock’s ascent. The stock also offers a modest dividend yield of 0.60% and trades at a P/E ratio of 36.72.

Chart courtesy of www.StockCharts.com

Apple specifically could be aided by federal policies favorable to clean energy, since it is seeking to become engaged heavily in electric vehicle and autonomous driving technology in the next few years, Kramer said. For example, Asian news reports indicate that Apple plans to invest $3.6 billion in South Korea’s Kia Motors Corp. to collaborate with the car manufacturer to develop electric vehicles.

Dividend-Paying Stocks of Nancy Pelosi and Her Husband to Purchase Are Supplemented by Tesla Options Trade

Despite Tesla’s towering 12-month P/E ratio of 171.13, compared to the domestic automotive industry’s 16.94, the company has been enticing new shareholders willing to pay the rocketing price. Tesla’s Chief Executive Officer Elon Musk attracted major news coverage on Feb. 8 when he announced his company is investing $1.5 billion in Bitcoin and will accept the cryptocurrency as payment for its vehicles. Tesla needs to outperform its rivals in share price gains, since it does not pay a dividend, in contrast to the average dividend yield of 0.7% for the industry and 1.6% for the S&P 500, according to StockRover.

The stock has jumped since Speaker Pelosi and her husband purchased shares in the company. As a supporter of clean-energy policies, Speaker Pelosi should benefit directly from any legislation, regulation or executive orders of President Joe Biden that support the sale of electric vehicles (EVs) from Tesla and other manufacturers that will offer an alternative to cars and trucks powered by conventional internal-combustion engines (ICEs).

Brian A. Johnson, automotive industry analyst with Barclays, is among those on Wall Street who describe Tesla as overvalued. However, Tesla now is able to ramp up production, fueled by newly raised capital that removes much of the downside risk to TSLA, he wrote in a recent research note. Johnson’s target on Tesla is $230, less than half its current share price.

Chart courtesy of www.StockCharts.com

Disney Suspended Its Payout Amid COVID-19 But May Join the Dividend-Paying Stocks of Nancy Pelosi and Her Husband

Jessica Reif Ehrlich, a seasoned media and entertainment analyst with BoA Global Research, recently wrote positively about Disney in a Feb. 12 research note and predicted brighter days ahead for the company with gradual increases in the percentage of capacity allowed at its theme parks and hotels. The company’s latest quarterly earnings results reported on Feb. 11 led to an increase in her price objective on Disney to $223, up from $192. Her “buy” rating on the stock remains, as she highlighted “robust” Disney+, Hulu and ESPN+ streaming services.

Key catalysts she cited include: (1) Disney+ price increases and more widespread launch in Japan, (2) theme park re-openings and capacity increases and (3) resumption of feature film/TV releases.

Chart courtesy of www.StockCharts.com

Vijay Jayant, an equity research analyst who focuses on media and entertainment companies at Evercore ISI in New York, wrote a Feb. 12 research note that identified positive signs in the first fiscal quarter ended January 2, 2021, despite Disney reporting a drop in diluted earnings per share (EPS) from continuing operations for the quarter of 98% to $0.02 from $1.17 in the prior year’s quarter. The company’s latest results reported improving momentum across multiple business lines, despite COVID-19.

Disney reported solid streaming trends, improving theme park results and aggregate numbers which broadly beat consensus forecasts, Jayant wrote. Most importantly, Disney added more than 26 million internet TV subscribers — in line with Evercore’s above-consensus estimate across four major services in the latest quarterly results that indicate the company remains solidly on-track to hit its long-range targets. The latest results should give investors incremental confidence in both the durability of streaming subscriber growth and the company’s entertainment parks that now appear to be in the early stage of recovery from COVID-19 effects. As a result, Jayant modestly increased fiscal year 2021 estimates for Disney, reiterated his “outperform” rating and boosted his price target to $210 from $200.

Dividend-Paying Stocks of Nancy Pelosi and Her Husband to Purchase Stand out Despite COVID-19

The COVID-19 pandemic killed more than 100,000 people in America in January 2021 to hit the top death total of any month since the deadly virus began spreading in the United States near the start of 2020, according to Johns Hopkins University. Food and Drug Administration (FDA) approval of the first COVID-19 vaccines is lifting hope as the highest-priority people receive injections. In the coming months, a semblance of normalcy may return if the virus can be contained.

COVID-19 cases have soared to heart-wrenching totals and continue rising as a second surge of infections rages. The number of cases reached 27,483,187 and led to a dreadful 480,567 deaths in the United States, as a huge part of 108,148,755 cases and 2,380,659 deaths worldwide, as of Feb. 12, Johns Hopkins University reported. America has the dubious distinction as the nation with the most cases and deaths.

Dividend-paying stocks of Nancy Pelosi and her husband to purchase provide potential investment ideas from a politically and financially shrewd power couple. Each individual investor needs to assess his or her level of risk tolerance and goals before deciding whether any of the trades pursued by House Speaker Pelosi and her husband on Dec. 22 may be appropriate nearly six weeks later for people of more modest means.