Featured Articles

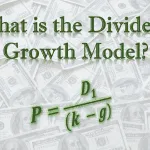

Dividend Definitions – What is the Dividend Growth Model?

Ned Piplovic | January 31, 2019

The dividend growth model is used to estimate the share-price value of a dividend-paying equity. Investors can use this estimated fair value of a particular stock as one of the components in their investment selection process. An equity whose current actual share price is lower than the fair value estimated by the dividend growth model could be an investment opportunity.…

Tax on Dividends – 6 Must-Know Facts

Ned Piplovic | January 30, 2019

While not a primary concern for most investors, the tax on dividends may come into play at a late stage in the investment selection process when investors have to make a final choice among equities with similar performance outlooks. Investors generally will look at easily accessible metrics, such as dividend yields, dividend payout ratios, history and level of annual dividend…

What are the Dividend Champions?

Ned Piplovic | January 30, 2019

Similar to the Dividend Aristocrats, the Dividend Champions is a group of stocks whose current streak of providing annual dividend hikes is at least 25 years. The main difference between the two groups is that Dividend Champions must meet the sole requirement of having at least 25 consecutive annual dividend boosts. Unlike the Dividend Aristocrats, the Dividend Champions do not have…

What is the Dividend Discount Model?

Ned Piplovic | January 29, 2019

The dividend discount model (DDM) is a method that investors and financial professionals use to calculate an equity’s share price by taking into account the impact of future dividend payments. Because the American economist Murray G. Gordon originally published the model in 1956, along with Eli Shapiro, this model is also frequently called the Gordon growth model (GGM). While published…

SPY Dividend: SDPR S&P 500 Index Dividend Payment Analysis

Ned Piplovic | January 28, 2019

The SPDR S&P 500 ETF Trust (NYSE:SPY) has been passing through dividend distributions from its underlying holdings to investors for more than two decades, and the annual dividend payment amount has risen for each of the past eight consecutive years. In addition to the steady flow of dividend income, SPY channeled to its shareholders the strong asset appreciation of its underlying…