High-Yield Fallen Angels Offer a Bond Market Sweet Spot

By: Bryan Perry,

On June 29, CNBC reported that, in addition to the previously announced intention to buy heavily into the investment-grade corporate bond market, the Fed disclosed it had purchased bonds in speculative-grade companies and exchange-traded funds (ETFs) that included the SPDR Bloomberg Barclays High Yield Bond ETF (JNK).

The Fed held a $412 billion position in JNK as of six weeks ago. When this data was released, no one said anything. When compared to the size of the junk bond market, this is a significant chunk of it.

This is akin to going in whole hog with unprecedented speed. The main driver was the swift and unprecedented actions from the Fed in what it must have deemed was a market that was about to fully lock up.

On March 23, the Federal Reserve announced the launch of the Primary Market Corporate Credit Facility (PMCCF) and the Secondary Market Corporate Credit Facility (SMCCF), allowing it to buy up to $750 billion of corporate bonds and corporate bond exchange-traded funds (ETFs).

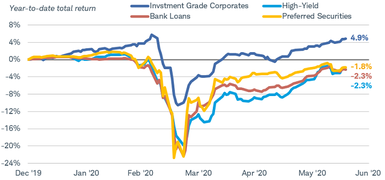

The SMCCF officially began buying ETFs on May 12 and began buying individual corporate bonds on June 16. After the investment-grade corporate bond market fell by 16% from peak to trough, and the high-yield market plunged by 22%, the Fed stepped in to stop the hemorrhaging.

Source: Bloomberg

This is a big deal because, as of early April, it was reported that the junk bond market in the United States stood at nearly $1.2 trillion. After growing rapidly over the past 10-15 years, high-yield bonds now comprise roughly 15% of the overall corporate (investment-grade) bond market, which is estimated at roughly $8.1 trillion. While this trails the U.S. Treasury market ($12.7 trillion outstanding), it is larger than the municipal bond market ($3.7 trillion).

The appetite for yield coming into 2020 was running high, even as the junk default rate rose to 3.3% in 2019, the highest level in three years and well above the non-recession norm of 2.4%, according to Fitch Ratings. Those defaults amounted to $38.6 billion, a 32% surge from 2018.

Energy, which had a default rate of 9.5%, was well above the 4.4% norm. However, it was also below its all-time peak of 19.7% in January 2017. Energy is the largest high-yield sector, though its share of the market is diminishing.

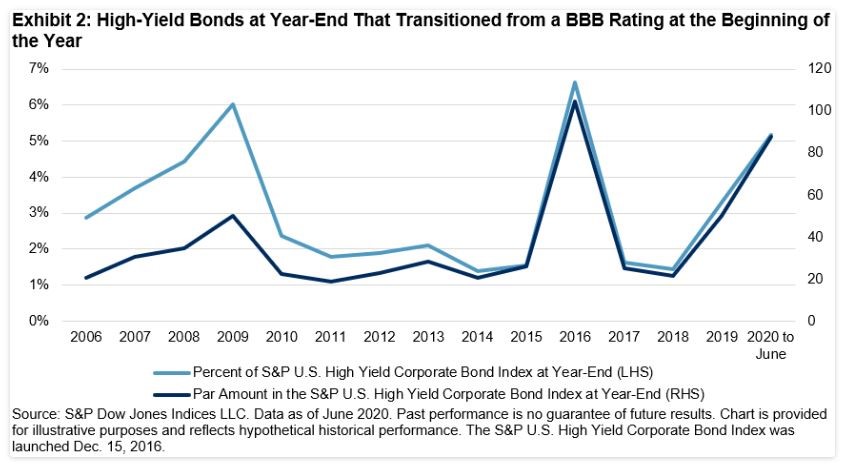

What is more concerning is that the share of BBB bonds that were downgraded to below an investment-grade rating has been on the rise since 2019. As of June 16, 2020, 5.2% of the S&P U.S. High Yield Corporate Bond Index came from the S&P U.S. Investment Grade Corporate Bond BBB Index as of the end of 2019. This is the highest it has been since 2009 and 2016.

These fallen angel bonds from the BBB rating have supplied $88 billion of supply to the high-yield bond universe so far this year.

Source: spglobal.com

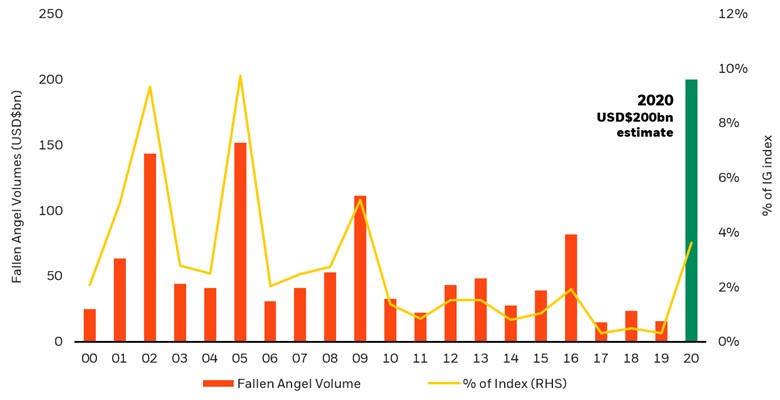

According to Citigroup, U.S. credit-ratings firms have downgraded $144 billion of bonds from investment-grade to junk, with some projecting at least $200 billion total over the course of 2020. The bigger number being reported by Citi implies that billions of bonds dropped from A or higher ratings straight to junk status. This meant that they bypassed a BBB rating altogether.

While the stabilizing forces of the Fed have supported and led a rebound in high-yield prices, BlackRock has noted that some longer-term fallen angel projections are as high as $700 billion — and BlackRock is the Fed’s primary corporate bond broker. Most of these dire predictions occurred before June, when conditions were looking pretty bleak.

History shows that fallen angel spread-widening typically occurs well ahead of any rating downgrades. So, investors who are invested in high-yield bonds should pay close attention to this potential canary-in-the-coal-mine scenario. The current market sentiment believes that “Quantitative Easing (QE) Forever” will provide whatever liquidity is required to sustain the credit markets.

Source: blackrock.com

I don’t think the markets have priced in whether or not businesses whose swelling debt load going into the pandemic has rendered them prone to suffer a long-term impact from the coronavirus. The positive news is that, with interest rates at historic lows, the opportunity to refinance current debt via new bond offerings might serve as the golden goose for cash-strapped companies that need time to get beyond COVID-19.

If there is a sweet spot in the high-yield market, it lies with the fallen angel bonds that can be found in funds like the VanEck Vectors Fallen Angel High Yield Bond ETF (ANGL). ANGL sports a 5.06% current yield and pays out monthly. The average duration on its bonds is 6.2 years, and the average yield to maturity is 5.96%. This means that most of the 329 issues it holds within its $2.8 billion in assets are trading at a slight discount to par.

When economic growth is finally restored, those fallen angel BB bonds could easily regain their BBB investment-grade status. Through using the iShares iBoxx $ Investment Grade Corporate Bond ETF (LQD) as a comparison factor, BBB-rated bonds have an average yield around 2.9%. So, closing the spread between ANGL and LQD would imply healthy price appreciation ANGL shares.

Treasury and investment-grade bond markets look like they are priced to perfection. Indeed, some blooms have already came off of the rose as of last week. The broader high-yield market, which is represented by the iShares iBoxx $ High Yield Corporate Bond ETF (HYG). It yields 5.05% and is, from my point of view, priced to perfection. 42.2% of the fund is rated below BB.

If there is an upside trade left in the universal corporate bond market, it likely exists with the BB fallen angels. I have no position in any of these three funds, but if I did, it would be the one that has wings.