Southern Company Boosts Annual Dividend 18 Consecutive Years, Offers 4% Dividend Yield (NYSE:SO)

By: Ned Piplovic,

The Southern Company (NYSE:SO) — a utility company that serves primarily 11 states in the U.S. Southeast — has rewarded its shareholders with 18 consecutive years of annual dividend hikes and currently offers a 4% dividend.

In addition to the rising long-term dividend income, the company also provided its shareholders with a relatively robust asset appreciation, especially since the beginning of the year. Even after dropping nearly a quarter of its value in the aftermath of the 2008 financial crisis, the share price recovered quickly and has more than doubled since its 15-year low in March 2009.

Amid current concerns about declining interest rates and worries over a potential global economic slowdown, investors might seek to shelter at least a portion of their investment in the Utilities sector, which is more resistant to economic downturns than many other sectors. However, investors must conduct their own due diligence to confirm that the Southern Company stock is a good fit with their investment portfolio goals.

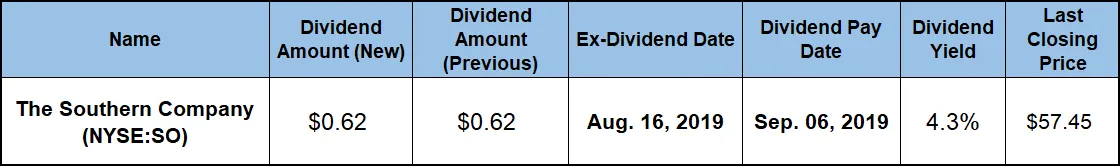

Interested investors should consider acting quickly. The company has set its next ex-dividend date for August 16, 2019. Therefore, any investors that wish to claim eligibility for the next round of dividend distributions on the September 6, 2019, pay date must claim stock ownership before the ex-dividend date next week.

Dividend Yield" width="1120" height="166" />

Dividend Yield" width="1120" height="166" />

The Southern Company (NYSE:SO)

Founded in 1945 and headquartered in Atlanta, The Southern Company, through its eleven regulated utilities, engages in the generation, transmission and distribution of electricity. The company also constructs, acquires, owns and manages power generation assets, including renewable energy projects, sells electricity in the wholesale market and distributes natural gas. As of June 2019, the company owned and operated 44,000 MW of generating capacity, which comprises 33 hydroelectric generating stations, 29 fossil fuel generating stations, three nuclear generating stations, 14 combined cycle/cogeneration stations, 33 solar facilities, nine wind facilities, one biomass facility and one landfill gas facility. Additionally, the company’s assets include nearly 200,000 miles of electric transmission and distribution lines, as well as more than 80,000 miles of natural gas pipeline. The company manages 1,500 billion cubic feet of combined natural gas consumption and throughput volume annually. Southern Company operates in 19 U.S. states and provides services to approximately nine million customers with a projected regulated rate base of approximately $50 billion. Additionally, the company also provides digital wireless communications services with various communication options, including push to talk, cellular service, text messaging, wireless internet access and wireless data.

The share price entered the trailing 12-month period on a downtrend and declined another 13% before reaching its 52-week low of $42.66 on September 26, 2018. After bottoming out in late September, the share price reversed direction and recovered all those losses by early-December 2018. However, substantial downward pressure from the overall market correction in the fourth quarter, pushed the share price back down. By December 24, 2018, the share price was back down to $43.02, which was just 0.8% above the 52-week low from late September.

However, the share price has been rising since the overall market pressure lessened at the end of December 2018. In just three weeks, the share price rose back to its level from the beginning of the trailing 12-month period and advanced another 17% before reaching new all-time highs in early-June 2019. After hitting a series of 10 new highs, the share price rose to reach its most recent all-time high of $57.45 on August 7, 2019. The August 7 closing price was 17% higher than it was one year earlier, as well as nearly 35% above the 52-week low from late-September 2018. Also, the share price gained nearly 35% in the last seven months since dropping to a near-low in late-December 2018.

The current $0.62 quarterly dividend payout amount marks a 3.3% increase over the $0.60 distribution from the same period last year. This current quarterly amount corresponds to a $2.48 annualized distribution and a 4.3% forward dividend yield. While the Southern Company enhanced its annual dividend payout amount nearly 20%, the share price advanced more than 30% over the same period. Because the asset appreciation outpaced the dividend payout growth, the current dividend yield is 4% lower than the company’s own 4.5% dividend yield average over the last five years.

While lagging slightly below its own five-year average, the Southern Company’s current dividend yield outperformed the 2.02% simple average yield of the entire Utilities sector by nearly 114%. Additionally, even compared to the 2.22% average yield of the company’s peers in the Electric Utilities industry segment, the Southern Company’s current yield is almost 95% higher. Even disregarding all the companies that currently pay no dividends increased the segments yield average to 3.82%. Therefore, the Southern Company’s current yield is 13% higher than the average dividend yield of the Electric Utilities segment’s only dividend-paying companies.

The Southern Company began distributing dividends in 1946 and has not missed a quarterly payout since then. In addition to this long streak of dividend payouts, the company also rewarded its shareholders with annual dividend hikes for the past 18 consecutive years. Over that period, the company nearly doubled its total annual payout amount. This level of advancement is equivalent to an average growth rate of 3.5% per year.

The Southern Company’s asset appreciation and dividend income distributions combined to deliver a 22% total return on shareholders investment over the trailing 12 months. The aggregate dividend distributions over the past three years were nearly five times higher than the payout over the last year — $11.84 versus $2.44. However, a decline in early 2018 dropped the share price to a level that was 7% lower than it was three years ago. Therefore, the total return over the past three years of 23% is only one percentage point higher than the one-year total return. However, the shareholders enjoyed a 62% total return over the last five years.

Dividend increases and dividend decreases, new dividend announcements, dividend suspensions and other dividend changes occur daily. To make sure you don’t miss any important announcements, sign up for our E-mail Alerts. Let us do the hard work of gathering the data and sending the relevant information directly to your inbox.

In addition to E-mail Alerts, you will have access to our powerful dividend research tools. Take a quick video tour of the tools suite.